Senores Pharmaceuticals Allotment IPO

Senores Pharmaceuticals Allotment IPO will be finalized on Thursday, December 26, 2024. The Senores Pharmaceuticals listing IPO is set to take place on Monday, December 30, 2024, marking the official debut on the stock exchange.

Senores Pharmaceuticals Allotment IPO Status

The allotment status for Senores Pharmaceuticals IPO will be finalized on Thursday, December 26, 2024. Investors can check their status through the registrar’s website or the BSE India portal by providing required application details.

If shares are allotted, they will be credited to the investor’s demat account. Unsuccessful bidders will receive refunds in their registered bank accounts within the specified timeline.

How to Check Senores Pharmaceuticals IPO Allotment Status?

Once the subscription period ends, the allotment process for Senores Pharmaceuticals IPO begins. Investors can check their allotment status via the registrar’s website or the BSE India website by providing necessary application details.

To check through the registrar’s website, visit the official site (e.g., Link Intime), select “Senores Pharma IPO” from the dropdown, and enter your PAN, application number, or DP ID/Client ID. Click “Submit” to view the status.

Alternatively, on the BSE website, go to the “IPO Allotment Status” section, select “Equity,” choose “Senores Pharmaceutical Limited IPO,” and provide your application details. If shares are allotted, they will be credited to your demat account, while refunds for unsuccessful applications will be processed to your bank account.

Read More: Ather Energy IPO

What Happens After Senores Pharma IPO Allotment?

After Senores Pharma IPO allotment, several key steps follow to finalize the process and allow trading of the shares. Here’s what happens next:

- Credit of Shares: Allotted shares are credited to investors’ demat accounts.

- Refunds for Unsuccessful Bids: Refunds are processed to the bank accounts of unsuccessful applicants.

- Pre-listing Preparations: The company and exchanges prepare for the public listing of shares.

- Listing on Stock Exchange: Shares begin trading on stock exchanges (NSE/BSE) on the listing date.

- Price Discovery: The market determines the trading price based on demand and supply on listing day.

Senores Pharma IPO Listing Date

The Senores Pharma IPO is set to list on Monday, December 30, 2024. This marks the day when the company’s shares will begin trading on stock exchanges like NSE and BSE.

Investors can buy or sell the shares publicly from this date, reflecting the IPO’s market debut. Keep an eye on the listing for potential price movements and market activity.

Key Details of the Senores Pharma IPO

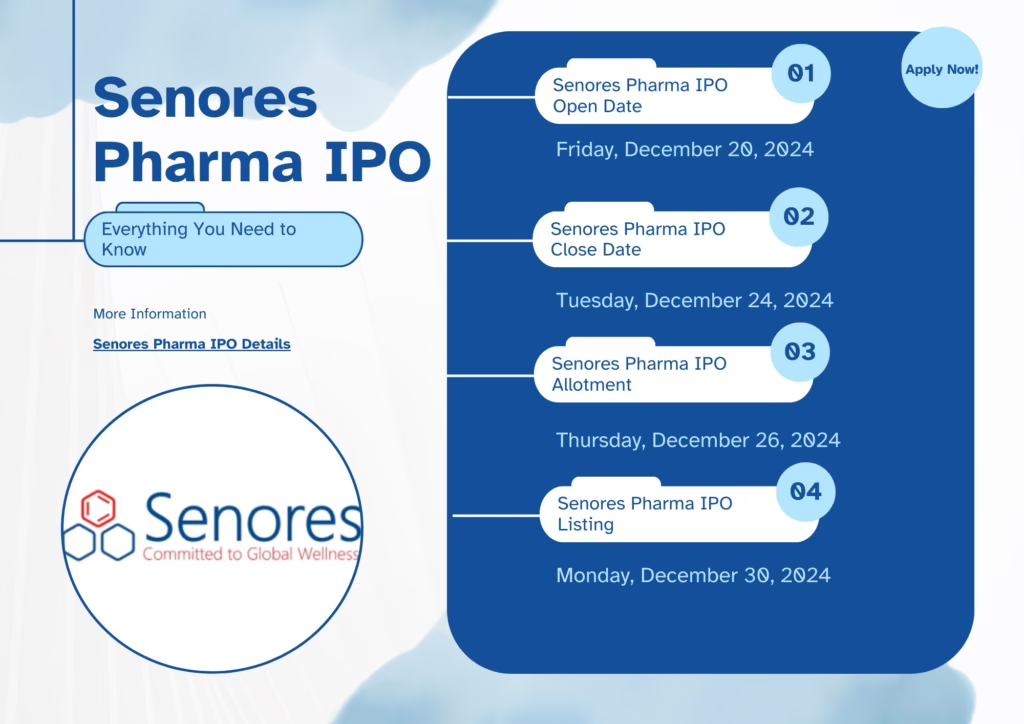

Senores Pharma IPO opens on December 20, 2024, and closes on December 24, 2024. Allotment is finalized on December 26, refunds and share credits on December 27, and shares list on December 30 at ₹372-₹391 per share.

| Senores Pharmaceuticals IPO Details | |

| Senores Pharma IPO Open Date | Friday, December 20, 2024 |

| Senores Pharma IPO Close Date | Tuesday, December 24, 2024 |

| Basis of Allotment | Thursday, December 26, 2024 |

| Initiation of Refunds | Friday, December 27, 2024 |

| Credit of Shares to Demat | Friday, December 27, 2024 |

| Listing Date of Senores Pharma IPO | Monday, December 30, 2024 |

| Face Value of Senores Pharma IPO | ₹10 Per Share |

| Price Band of Senores Pharma IPO | ₹372 to ₹391 Per Share |

| Lot Size of Senores Pharma IPO | 38 Shares |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

Senores Pharmaceuticals IPO Subscription Status

Senores Pharmaceuticals IPO subscription status as of 5:00 PM on December 20, 2024, shows Qualified Institutional Buyers (QIBs) at 0.01x, Non-Institutional Investors at 1.67x, Retail Individual Investors (RIIs) at 7.19x, Employees at 1.88x, and the total subscription at 1.78x.

| Investor Category | Subscription |

| Qualified Institutional Buyers(QIBs) | 0.01x |

| Non Institutional Investors | 1.67x |

| Retail Individual Investors(RIIs) | 7.19x |

| Employees | 1.88x |

| Total | 1.78x |

Click The Link To Know More.

Senores Pharmaceuticals IPO GMP

The Grey Market Premium (GMP) for Senores Pharmaceuticals IPO is ₹200. This reflects the price investors are willing to pay in the unofficial market before the shares are officially listed.

GMP provides an early indication of market demand and potential listing gains. However, it is not an official measure and can fluctuate based on market sentiment and speculation.

Factors Driving Senores Pharma Popularity

Senores Pharma’s rising popularity can be attributed to several key factors that distinguish it in the pharmaceutical industry. These factors highlight its potential for growth and impact on healthcare.

- Quality and Affordable Products: Senores Pharma is known for offering high-quality yet affordable medicines, making healthcare accessible to a wider audience.

- Innovative Research and Development: The company focuses on continuous R&D to develop new and effective treatments, catering to emerging medical needs.

- Strong Distribution Network: A robust supply chain ensures timely availability of products across various regions, enhancing accessibility.

- Compliance with Regulatory Standards: The company adheres to stringent regulatory guidelines, ensuring the safety and efficacy of its products.

- Focus on Customer Satisfaction: With customer-centric policies, Senores Pharma prioritizes patient care and satisfaction, building trust in its brand.

Risks and Challenges for Investors of Senores Pharmaceuticals IPO

Investing in the Senores Pharmaceuticals IPO carries certain risks and challenges that investors should be aware of before applying. These factors can impact the overall investment returns and market performance.

Risks and Challenges for Investors:

- Market Volatility: The pharmaceutical sector can be highly volatile, affected by changing market conditions and regulatory approvals.

- Regulatory Risks: Changes in government policies or healthcare regulations could negatively impact the company’s growth prospects.

- Competition: Intense competition from both established and emerging pharmaceutical companies may limit Senores Pharmaceuticals’ market share.

- Financial Performance: The company’s past financial performance and future profitability may fluctuate, leading to investment uncertainty.

- Product Development Risks: Delays or failures in new product launches or approvals can adversely affect revenue generation.

- Liquidity Risks: Low trading volumes post-listing may make it challenging for investors to buy or sell shares at favorable prices.

- Industry-specific Risks: Risks such as patent expirations, drug price controls, or changes in healthcare policies could impact profitability.

Read More : IPO Allotment Process: 4 Simple Steps, Best Allotment Tips, and Examples

Conclusion – Senores Pharmaceuticals IPO

- Senores Pharmaceuticals IPO opens on Friday, December 20, 2024.

- Senores Pharma IPO closes on Tuesday, December 24, 2024.

- Senores Pharmaceuticals Limited IPO allotment will be finalized on Thursday, December 26, 2024.

- Senores Pharma IPO refunds and credit of shares to Demat accounts will occur on Friday, December 27, 2024.

- Senores Pharmaceuticals IPO listing date is set for Monday, December 30, 2024.

- Senores Pharma IPO has a face value of ₹10 per share.

- Senores Pharmaceuticals Limited IPO price band ranges from ₹372 to ₹391 per share.

- Senores Pharma IPO lot size is 38 shares.

- Senores Pharmaceuticals IPO is a book-built issue IPO.

- Senores Pharma IPO will be listed on both BSE and NSE.

Disclaimer

The information provided on Funds and Savings is for informational and educational purposes only and should not be considered as financial or investment advice.

Pingback: Mamata Machinery IPO GMP and Allotment Status

Pingback: IPO Allotment Process - 4 Simple Steps & Best Allotment Tips