Investing in Gold in India: Comparing Physical Gold, Digital Gold, Gold ETFs, Gold Funds, and SGBs

Gold has always held a special place in Indian households. From grandma’s jewelry to lavish wedding gifts, Indians love investing in gold. In fact, it’s often said that Indian households collectively own around 11% of the world’s gold! Why is gold so popular? Because it’s seen as a safe haven – an asset that can protect wealth during tough times.

Historically, gold has given moderate returns (around ~9% annually over decades in India) but, more importantly, it acts as a cushion when markets are down or inflation is up.

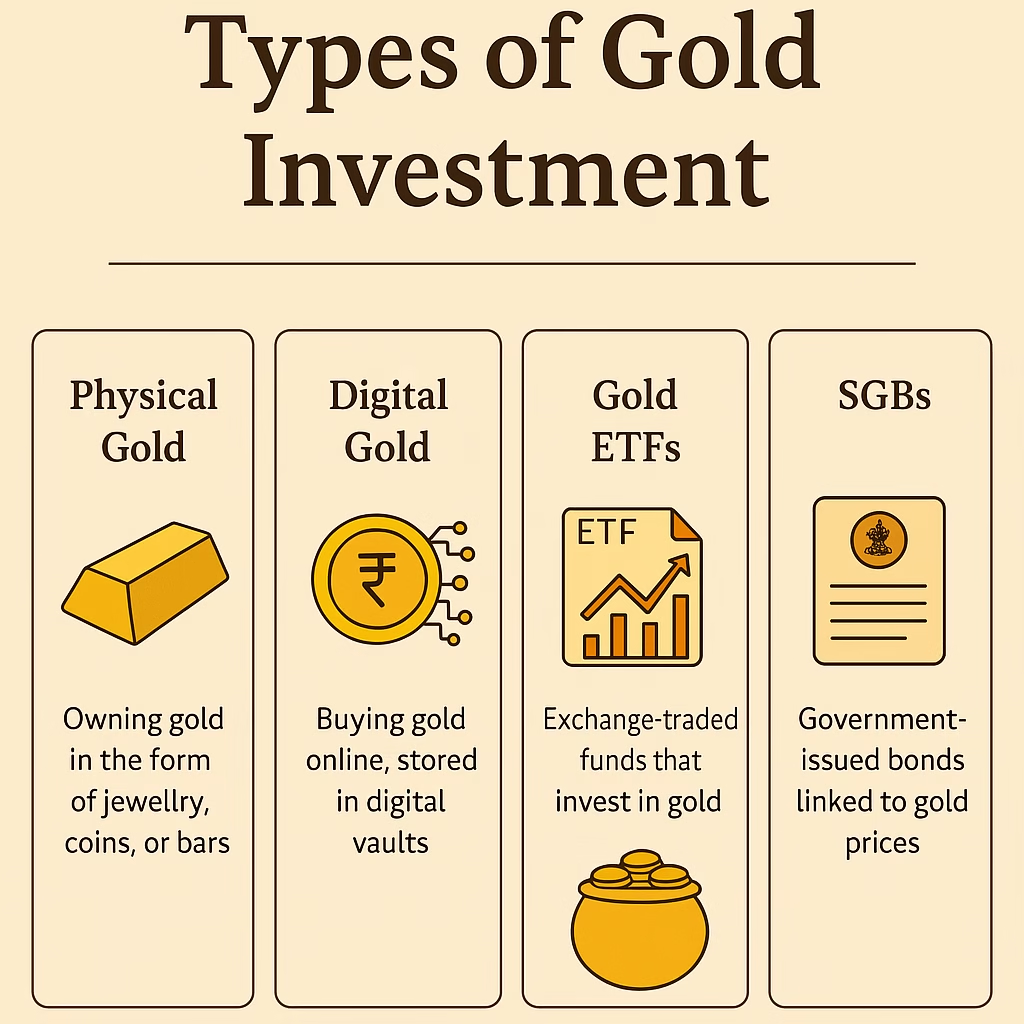

If you’re a new investor wondering about the best way to invest in gold, you might be surprised to learn there are several options beyond just buying physical gold. Today, you can invest in gold through physical forms or various “paper”/digital forms. Each comes with its own pros and cons.

In this friendly guide, let’s break down the types of gold investment options available in India – Physical Gold, Digital Gold, Gold ETFs, Gold Mutual Funds, and Sovereign Gold Bonds (SGBs) – and see how they compare. We’ll also give you a handy comparison table and tips to choose the right method for your needs.

Physical Gold

When most people think of investing in gold, they picture buying gold jewelry, coins, or bars and physically holding that gold. Physical gold means you have the tangible metal in your hands (or locker!). This is the traditional way to invest in gold in India.

What it is: Buying gold in its physical form – typically jewelry, gold coins, or bullion bars. You can purchase these from jewelry shops, banks (coins), or authorized dealers. Indians also often buy gold during festivals like Dhanteras or Akshaya Tritiya as a cultural tradition of investing.

Pros:

- Tangible Asset: You can see and touch your investment. Many people find comfort in holding real gold. You can also use it – e.g. wear jewelry – which is a dual benefit of investment + adornment.

- Easy to Buy/Sell: Widely accessible – walk into any jewelry store or bank and you can buy gold. Selling is also fairly straightforward; most jewelers will buy it back (though at a slight deduction).

- No Demat Required: You don’t need any special account or technology – no Demat or online platform is required, making it simple for anyone.

Cons:

- Making Charges & Premiums: If you buy jewelry, you pay high making charges (crafting fees) often ranging ~5-15% of the gold value, which you won’t get back when selling. Even coins/bars might have a small premium over market price. This increases your cost.

- Taxes: Physical gold purchases incur 3% GST on the value. When you sell, if the price has gone up, you may have to consider capital gains taxes as well.

- Storage & Security: Keeping physical gold safe is a concern. You might need a locker in a bank which has annual fees, or find a secure place at home. There’s always a risk of theft or loss with physical holdings.

- Purity and Resale: You must ensure the gold’s purity (hallmarked 22K/24K, etc.). When selling, you may not get the full market price especially for jewelry (deductions for purity, damage, or simply dealer margins).

In short, physical gold is great for those who value holding a real asset (and maybe wearing it too), but the costs and risks (making charges, theft) are the trade-offs. It’s more than just an investment in India – it carries emotional and cultural value – but purely financially, you should be aware of the extra costs.

Digital Gold

Moving to the modern option: Digital Gold. If you want to invest in gold without dealing with lockers and physical coins, digital gold might be appealing. This has become popular with the rise of fintech apps.

What it is: Digital gold is essentially buying gold online through platforms like Paytm, Google Pay, PhonePe, or broker apps, where your gold purchase is stored in a digital vault. You pay money to buy a certain amount of gold (even as little as ₹1 worth of gold), and the provider purchases and stores that equivalent gold on your behalf in a secure vault. You get a digital certificate or account statement showing your gold holding. You can later sell it back online or even convert to physical gold (often delivery is allowed once you accumulate a certain quantity like 1 or 2 grams).

Pros:

- High Accessibility & Convenience: Super easy to buy – available 24×7 through mobile apps and websites. You can purchase with a few clicks. No need to visit a store or worry about store timings.

- Small Investments Possible: You can start with very small amounts (even ₹100 or less, some platforms allow ₹1 minimum!). This makes gold investing accessible to anyone, even if you just want to put a tiny amount regularly.

- No Storage Hassles: The gold is stored on your behalf by the service provider (in secure vaults insured by them), so no need for a locker or fear of personal theft. It’s safe in a digital vault.

- Easy Liquidity: Selling is quick – you can sell your digital gold back to the platform anytime and the money gets credited to your account. No need to find a buyer yourself.

Cons:

- Not Regulated (Trust Factor): Digital gold is not tightly regulated by RBI or SEBI as of now. It’s offered by fintech firms in partnership with gold trading companies. This means you have to trust the provider that they are actually holding your gold safely. Reputable providers do audit their gold holdings, but there’s a slight element of counterparty risk.

- Costs and Spread: While there’s no making charge, you still pay a price premium. Platforms charge a spread (margin) above market gold price when you buy (and a slight discount when you sell). Typically, there’s also 3% GST on purchase. The spreads can be around 2-3% (varies by provider). Overall, you might be paying ~5-6% above the actual gold rate (spread + GST). This is less than jewelry making charges, but still a cost to note.

- No Physical Enjoyment: Since it’s digital, you can’t wear or gift it in the same way as a gold necklace. While you can convert to physical coin delivery, that often involves additional shipping and making charges. So if your goal was to have jewelry or coins in hand, digital gold is just a temporary digital proxy.

- Selling Limits: Some platforms might have daily transaction limits or slight delays for large sums. Also, you rely on the platform’s liquidity (generally not a big issue as they assure buyback, but something to keep in mind).

Digital gold is a convenient way to invest in gold for beginners and small investors. It’s great if you want to accumulate gold gradually without worrying about safekeeping. Just be mindful that it isn’t government-regulated like a bank; choose well-known platforms so you’re confident in what you’re buying.

Gold ETFs

Next up are Gold ETFs, which stands for Gold Exchange Traded Funds. These fall into the category of “paper gold” (or you can call it digital gold investment through the stock market). Gold ETFs have been around for over a decade in India.

What it is: A Gold ETF is a type of mutual fund that trades on the stock exchange like a share. Each unit of a gold ETF represents a fixed quantity of gold (for example, many gold ETFs represent 1 gram of gold per unit, or sometimes 1/2 gram or 1/100th depending on the fund). When you buy units of a gold ETF, the fund actually holds that much physical gold (99.5% purity or higher) in a vault as the underlying asset. The price of the ETF unit moves in line with gold prices in the market. You need a Demat account and trading account to buy/sell ETFs (just like buying a company stock).

Pros:

- Low Cost & Efficient: Gold ETFs have low management fees (expense ratios usually around 0.5% per year or even less). There are no making charges, no GST on purchase (since you’re buying securities), and the pricing is usually very close to actual gold market price. It’s one of the most cost-effective ways to invest in gold.

- Purity and Transparency: Each unit is backed by physical gold of high purity held by the fund. You don’t worry about purity or fraud – the fund manager and custodian take care of that. Prices are transparent on the stock exchange.

- Easy to Buy/Sell (for Demat users): If you already have a Demat/trading account, buying a gold ETF is as simple as buying a share of Infosys. You can trade during market hours and get the prevailing market price. This makes it fairly liquid (especially for the larger gold ETFs with good trading volumes).

- No Storage Hassles: You don’t hold the gold, so no physical storage issues for you. The gold is stored by the fund’s custodian. You just see the units in your demat account.

Cons:

- Requires Demat Account: The main barrier is you must have a Demat and trading account. If you’re not already investing in stocks, this is an extra step (which involves KYC, account opening, etc.). For purely traditional investors, this could be a small hurdle.

- Market Hours and Liquidity: You can only buy or sell ETFs during stock market hours. If you need cash in an emergency at an odd hour, you can’t instantly liquidate like digital gold. Also, some smaller gold ETFs might have lower trading volumes, meaning occasionally the buy/sell spread on the exchange could widen. Generally, the popular ETFs are liquid, but it’s a factor to consider (you might not always get the absolute best price at a low-liquidity moment).

- Small Fees: While costs are low, note that you might pay a brokerage fee when buying/selling (though many brokers offer free ETF trading nowadays) and annual demat charges. These are usually quite minimal, but not zero.

- Taxation: Gold ETFs are treated as non-equity investments for tax – if you sell after 3 years, you get indexation benefit and 20% tax on gains; if before 3 years, gains are added to income. (Same tax treatment applies to physical gold, digital gold, and gold funds as well, by the way, except SGBs). This is just a point to know – not a disadvantage per se, but unlike physical gold, you can’t completely escape taxes on gains (though with jewelry people sometimes bypass if sold informally, but one should pay taxes on any capital gains legally).

Overall, gold ETFs are an excellent option for investors who are a bit more financially savvy or already in the stock market ecosystem. They’re cost-effective, transparent, and relatively liquid. It’s a pure investment in gold price without the frills.

Read On: Old vs New Tax Regime for FY 2025-26: Which One Saves You More?

Gold Mutual Funds (Gold Fund of Funds)

Gold mutual funds are another “paper gold” avenue, quite similar to gold ETFs in outcome, but they work a bit differently. These are often fund of funds that invest in gold ETFs, or sometimes in overseas gold mining companies (but in India, the common ones invest in Gold ETFs). For our comparison, we’ll refer to the common Gold Savings Funds offered by various Indian AMCs, which simply hold units of a Gold ETF on your behalf.

What it is: A Gold Mutual Fund (often called Gold Savings Fund or Gold Fund) is a mutual fund scheme where the fund collects money from investors and invests primarily in physical gold or gold ETF units. The NAV of the fund moves with gold prices (after accounting for expenses). The big difference from a gold ETF is that you don’t need a Demat account to invest in a gold mutual fund – you can invest through the fund house or any platform like any other mutual fund scheme. You can also set up a SIP (Systematic Investment Plan) to invest small amounts monthly.

Pros:

- No Demat Required: This is the easiest way to invest in gold for someone without a Demat account. If you are comfortable with mutual funds (via an app or your bank), you can just buy a gold fund directly with money from your bank.

- Small Investment & SIP: Most gold funds have a low minimum investment, often around ₹500 or even ₹100 for some, especially via SIP. It’s great for regular investing – you can automate monthly investments (SIP) to accumulate gold over time.

- Professional Management: Though it’s straightforward (since they usually just buy a gold ETF), you have the backing of a professional fund management company handling the purchases and storage via the ETF. They take care of rebalancing or any operational issues.

- Liquidity and Convenience: You can redeem your gold fund units on any business day directly with the mutual fund (no need to find buyers). The money (at the prevailing NAV) typically comes into your bank in T+1 or T+2 days. There’s no concern of finding market liquidity like an ETF; the fund house will redeem your units at NAV. Also, you can do all this online easily.

Cons:

- Expense Ratio (slightly higher): Gold mutual funds charge an expense ratio as well (which includes the underlying ETF’s cost plus the fund’s own fees). This could be around 0.5% to 1% annually. This makes it a tad more expensive than holding a gold ETF directly, because there’s an extra layer. However, the convenience (no demat needed, SIP possible) might outweigh this for many.

- Exit Load: Some gold funds might have a small exit load if you redeem within a short period (say 1% if you sell before 1 year). This is to discourage very short-term trading. If you plan to invest and hold or do SIP long-term, this isn’t a big issue, but it’s a factor if you were thinking to pull out quickly.

- NAV Pricing (no intraday trade): Unlike an ETF which you can buy/sell at real-time prices, a mutual fund only lets you transact at end-of-day NAV price. So you cannot time the market intraday. If gold price shoots up or down during the day, you don’t lock-in that price until the day’s NAV is calculated.

- Similar Market Risks: Just like gold ETF, the gold fund’s value will fluctuate with gold prices. There’s no additional diversification (unless it’s a different kind of fund that also invests in miners, but those are uncommon in India for now). So it’s basically gold price risk, nothing more, nothing less – which is true for all these options.

In summary, a gold mutual fund is basically a user-friendly wrapper around gold ETFs. It’s great for those who want to invest in gold without the hassles of demat or who prefer the mutual fund route (especially for features like SIP). The costs are slightly higher than a direct ETF, but for small investors the difference may be negligible considering the small amounts and convenience.

Gold Mutual Fund vs Gold ETF: A common question is, “Gold mutual fund vs gold ETF – which is better?” The answer usually boils down to whether you have a demat account and your investment style. Gold ETFs have slightly lower expense and are traded in real-time, but you need a demat account and you typically would invest in lumps or by manually buying units. Gold funds allow SIPs and no demat requirement, making them ideal if you want to invest bit-by-bit regularly or aren’t into stock trading. If costs are your primary concern and you have demat access, go for the ETF. If convenience and small regular investing matter more, the gold mutual fund is a fine choice. In the end, both give you the same exposure to gold price.

Sovereign Gold Bonds (SGBs)

Lastly, one of the most interesting options: Sovereign Gold Bonds (SGBs). These are quite different from the above, because they are actually government bonds, but their value is linked to gold price. The Government of India started the SGB scheme to offer an alternative to owning physical gold.

What it is: An SGB is essentially an 8-year bond issued by the Reserve Bank of India (on behalf of the Government), denominated in grams of gold. For example, you buy 1 unit of SGB which equals 1 gram of gold (minimum investment is 1 gram). The issue price of the bond is set based on the prevailing market price of gold (usually an average of recent prices). Once you buy it, you hold the bond certificate (or it can be in your demat). It pays you 2.5% interest per annum (fixed) on the initial price (this interest is paid semi-annually to your bank account). When the bond matures after 8 years, you get the redemption value equal to the prevailing price of 1 gram of gold at that time. In other words, you get the gold’s price appreciation plus you earned 2.5% per year interest in the interim. The neat part: if you hold till maturity, any capital gains are tax-free (the government currently exempts capital gains tax on maturity of SGBs). You don’t actually get physical gold at the end – you get the cash equivalent of the gold’s value.

Pros:

- Sovereign Backing (Low Risk): SGBs are backed by the Government of India, so there’s no credit risk. You don’t have to worry about purity, storage, or any company defaulting. It’s as safe as a government bond.

- Regular Interest Income: Unlike all other gold investments, this one actually pays you interest (2.5% per year). This is a great bonus – you get some steady return irrespective of gold price movement, straight to your bank. It’s like getting a small annual yield on your gold investment.

- No Making Charges/Fees: There are virtually no ongoing costs. No expense ratio, no management fee. If you buy in the primary issue, there’s no brokerage. If you hold in demat, maybe just demat maintenance fees apply. In fact, if you apply online, you often get a small discount (₹50 per gram off the issue price as an incentive).

- Tax Advantage: If you hold the bond to the full 8-year maturity, any gain is completely tax-free (which is a big advantage over physical gold or ETFs where you’d pay capital gains tax on profits). Even interest earned is taxable each year, but the capital appreciation isn’t taxed at the end if held to maturity.

- Can be Used as Collateral: Banks do accept SGBs as collateral for loans (just like physical gold). So it has an added use if you ever needed to take a loan, you could pledge your SGB instead of gold jewelry.

Cons:

- Lock-in & Liquidity Issues: The biggest drawback is low liquidity. SGBs have an 8-year tenor. There is an option to exit after 5 years (on interest payout dates) with the RBI, and you can also sell on stock exchanges before maturity. However, trading volumes on exchanges are usually low, meaning it might be hard to sell quickly at a fair price. If you try to sell early, you might have to sell at a discount. So essentially, be prepared to hold for a long term. This is not ideal if you might need the money back in a short time.

- Availability: SGBs are not available on tap all the time. The government opens subscription windows periodically (every few months in tranches). You can subscribe during that period through your bank, broker, or online. If you miss it, you have to wait for the next tranche or buy from someone on the secondary market. This makes it less convenient to buy anytime compared to other forms of gold. (On the flip side, the tranches are frequent enough through the year.)

- Interest Taxable: The 2.5% interest, while nice, is taxable as “income from other sources” each year. It’s not a big amount, but just remember it isn’t tax-free interest.

- No Actual Gold in Hand: With SGB you never get physical gold. It’s all paper (or digital demat) – purely an investment instrument. So if your aim was to eventually get gold for personal use, this won’t give you that (you’d have to sell the bond and then buy gold in the market separately).

Sovereign Gold Bonds are excellent for long-term investors who are certain they won’t need to liquidate early. They effectively give you the highest net returns on gold (due to interest and tax-free maturity), provided you hold to maturity. If you can work with the lock-in and the process of buying during issue periods, SGBs can be the best way to invest in gold for the long run.

Comparison of Gold Investment Options in India

It’s clear that each option – physical gold, digital gold, gold ETF, gold fund, and SGB – has its own advantages and disadvantages. Here’s a quick comparison summary of key factors to help you see how they stack up against each other at a glance:

| Option | Accessibility (Ease of Buying) | Risk (Beyond market price risk) | Costs (Fees/Premiums) | Minimum Investment | Liquidity (Ease of Selling) |

|---|---|---|---|---|---|

| Physical Gold | High – available at jewelry shops, banks anytime. | Theft risk; purity concerns. | High costs: ~5-15% making charges + 3% GST; storage locker fees. | Relatively High – at least cost of 1 gram (₹5,000+); more for jewelry pieces. | Moderate – can sell to jewelers easily, but may not get best price (deductions apply). |

| Digital Gold | Very High – buy online 24×7 via apps. | Platform risk (not regulated by SEBI/RBI); rely on provider’s trust. | Moderate costs: ~3% GST + ~2-3% provider premium (spread). | Very Low – you can start from as little as ₹1. | High – sell instantly on the platform, money is credited quickly (very liquid). |

| Gold ETF | Moderate – need a Demat & trading account; then easy during market hours. | Low risk; regulated product, slight liquidity risk if low trading volume. | Low costs: ~0.5% annual expense ratio; small brokerage; no GST/making charge. | Low – roughly the price of 1 unit (could be ~₹50–₹100, since 1 unit ≈ small fraction of 1g). | Moderate – fairly liquid on exchange, but only in market hours; selling large amounts depends on buyer availability. |

| Gold Mutual Fund | High – very easy; no Demat needed, invest via any mutual fund platform. | Low risk; regulated fund, underlying assets in gold/ETF. | Low to Moderate: ~0.5-1% annual expense; no direct GST (fund handles it); possible small exit load for early withdrawal. | Low – often ₹500 or even less (via SIP) to start. | Moderate – redeem with fund at NAV (takes 1-2 working days for money); no immediate trading but liquidity provided by the fund house. |

| SGB (Gold Bond) | Low – available only during specific issue windows (or via secondary market with effort). | Very Low risk; sovereign guarantee (no default risk). | Negative cost: No ongoing fees; actually pays you 2.5% interest yearly. (No making charge/GST either on issue.) | Moderate – minimum 1 gram worth (price of 1g, ~₹5,000-7,000 depending on gold price). | Low – long lock-in (8 years). Early exit difficult (after 5 years or via low-liquidity secondary market). Not suitable if you may need quick cash. |

(Note: All options are subject to gold market price risk – i.e., if gold price falls, the value of your investment falls. “Risk” in the table above refers to other risks like security, default, etc.)

As you can see, physical gold and digital gold are easiest to get but physical has extra costs and security issues, while digital requires trust in the platform. Gold ETFs and gold funds are great low-cost investment routes – ETFs if you’re market-savvy, and funds if you prefer simplicity. SGBs shine (pun intended) for long-term investment but score low on liquidity and availability.

Conclusion: Choosing Your Golden Path

Gold will likely continue to shine in the hearts and portfolios of Indian investors. Each investment method – be it the old-school charm of physical gold or the modern ease of digital and paper gold – offers a unique mix of benefits. New investors should take a moment to reflect on their own goals and circumstances. Do you crave the touch of gold in your hand, or are you happy with a digital number that grows with gold’s price? Are you investing for the long haul as a safety net, or looking to trade quickly when needed?

In the end, the best way to invest in gold is the one that makes you comfortable and fits your financial plan. Gold, in any form, can be a great diversifier and hedge in your portfolio. So choose your preferred gold investment option wisely, and rest easy knowing you’ve added a golden touch to your financial future. Happy investing!