How to Get Started with Algorithmic Trading Using API?

What Is Algorithmic Trading?

Algorithmic trading using api is the use of computer programs and algorithms to execute financial trades automatically. It leverages predefined rules, such as price, volume, or timing, to buy or sell assets. This technology enables faster, data-driven decisions, minimizing human error, and is widely used in markets for efficiency and profitability.

Why APIs are the Backbone of Algorithmic Trading?

APIs (Application Programming Interfaces) are the backbone of algorithmic trading because they facilitate seamless communication between trading algorithms and financial markets. APIs provide real-time access to market data, enabling algorithms to make informed decisions based on live or historical trends.

They also allow traders to execute orders instantly and precisely, reducing latency and human error. By offering features like account management, order execution, and portfolio tracking, APIs empower traders to automate complex strategies efficiently.

Moreover, APIs ensure scalability, enabling integration with multiple platforms and assets. In essence, APIs are the critical link that connects automated strategies to the dynamic world of trading.

Best Stock Broker for Algo Trading in India

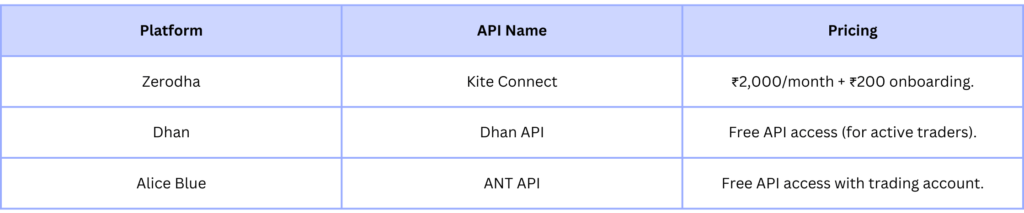

Algorithmic trading using APIs can be made easy with platforms like Zerodha, Dhan, and Alice Blue. Here’s how you can start:

| Platform | API Name | Key Features | Pricing |

| Zerodha | Kite Connect | Real-time market data, order execution, portfolio tracking, multiple asset classes. | ₹2,000/month + ₹200 onboarding. |

| Dhan | Dhan API | No-code strategies, access to live and historical data, integrations with third-party tools. | Free API access (for active traders). |

| Alice Blue | ANT API | Free market data API, algo-friendly order placement, easy integration with Python and Java. | Free API access with trading account. |

Step-by-Step Guide to Setting Up Your First Trading API

This guide will help you set up Alice Blue’s free trading API, authenticate using your credentials, and fetch historical data for backtesting or algorithmic trading. We’ll break down the provided Python code for clarity.

Step 1: Understanding API Basics

Alice Blue API: Allows you to connect to their trading platform to automate tasks such as fetching market data, placing orders, and managing your portfolio.

Key Components:

- API Key: A unique key provided by Alice Blue for API access.

- Encrypted Key (encKey): Used for secure authentication.

- Session ID: Required for authorization to interact with the API.

- Bearer Token: Final authorization token to use the API endpoints.

Step 2: Required Libraries

Make sure you install the required Python libraries:

pip install requests pandasStep 3: Setting Up the Code

Define the Base URL and Endpoints.

BASE_URL = "https://ant.aliceblueonline.com/rest/AliceBlueAPIService/api/"- This is the root URL for all API calls.

- Different endpoints (e.g., customer/getAPIEncpkey) are added to it to perform specific actions.

Step 4: Fetch the Encrypted Key (encKey)

The first step in authentication is obtaining the encrypted key:

- userId: Your Alice Blue account ID.

- apiKey: The unique API key you receive from Alice Blue.

Code Breakdown:

api_encp_key_endpoint = "customer/getAPIEncpkey" data = {"userId": userId} response = requests.post(BASE_URL + api_encp_key_endpoint, json=data)The API returns the encKey if successful.

Step 5: Generate the Session ID

Combine the userId, apiKey, and encKey to generate a secure session ID:

concatenated_string = userId + apiKey + enc_key

session_id = hashlib.sha256(concatenated_string.encode()).hexdigest()

get_user_sid_endpoint = "customer/getUserSID"

data = {"userId": userId, "userData": session_id}

response = requests.post(BASE_URL + get_user_sid_endpoint, json=data)- Use the session ID to request a User SID, which validates your session.

- The sessionID is extracted from the response and forms part of the Bearer Token.

Step 6: Generate the Bearer Token

The final authorization token combines the userId and sessionID:

token_hist = f"Bearer {userId} {sessionID}"

Step 7: Fetch Historical Data

To fetch historical market data:

URL = "/rest/AliceBlueAPIService/api/chart/history"Create a JSON payload specifying:

- Token: The stock token or symbol.

- Time Range: Start and end timestamps.

- Resolution: Data frequency (e.g., daily or minute).

- Exchange: The market, such as NSE (National Stock Exchange).

Send the request:

payload = json.dumps({

"token": token,

"resolution": "D",

"from": start_date,

"to": end_date,

"exchange": "NSE"

})

headers = {"Authorization": token_hist, "Content-Type": "application/json"}

conn = http.client.HTTPSConnection(BASE_URL)

conn.request("POST", URL, payload, headers)

res = conn.getresponse()

json_data = json.loads(res.read().decode("utf-8"))Step 8: Backtest Your Strategy

Using the historical data, you can test a strategy like the 53 week high or low breakout strategy. The backtest function:

Fetches historical data using get_ticker_data.

df = pd.DataFrame(json_data['result'])

Applies the strategy logic to evaluate performance.

Complete Code to get data from Alice Blue API

# Headers

import requests

import hashlib

import http.client

import json

import pandas as pd

# Function to get Bearer Token

def get_bearer_token():

BASE_URL = "https://ant.aliceblueonline.com/rest/AliceBlueAPIService/api/"

api_encp_key_endpoint = "customer/getAPIEncpkey"

# Replace with your actual credentials

userId = "<replaceUserId>"

apiKey = "<API KEY>"

encKey = "<enc key>"

# Step 1: Get Encrypted Key (encKey)

url = BASE_URL + api_encp_key_endpoint

data = {"userId": userId}

response = requests.post(url, json=data)

if response.status_code == 200:

response_json = response.json()

enc_key = response_json.get('encKey')

if enc_key:

print("encKey retrieved successfully.")

else:

print("encKey not found in response.")

return None

else:

print(f"Failed to get encKey. Status code: {response.status_code}")

print("Response Text:", response.text)

return None

# Step 2: Generate Session ID

concatenated_string = userId + apiKey + enc_key

session_id = hashlib.sha256(concatenated_string.encode()).hexdigest()

# Step 3: Get User SID

get_user_sid_endpoint = "customer/getUserSID"

url = BASE_URL + get_user_sid_endpoint

data = {"userId": userId, "userData": session_id}

response = requests.post(url, json=data)

if response.status_code == 200:

response_json = response.json()

sessionID = response_json.get('sessionID')

print("Session ID retrieved successfully.")

else:

print(f"Failed to get sessionID. Status code: {response.status_code}")

print("Response Text:", response.text)

return None

# Generate Bearer Token

token_hist = f"Bearer {userId} {sessionID}"

return token_hist

# Function to Fetch Historical Data

def get_ticker_data(start_date, end_date, token, token_hist):

BASE_URL = "ant.aliceblueonline.com"

URL = "/rest/AliceBlueAPIService/api/chart/history"

payload = json.dumps({

"token": token,

"resolution": "D", # Daily data

"from": start_date, # Timestamp in milliseconds

"to": end_date, # Timestamp in milliseconds

"exchange": "NSE" # Exchange: NSE

})

headers = {

"Authorization": token_hist,

"Content-Type": "application/json"

}

conn = http.client.HTTPSConnection(BASE_URL)

conn.request("POST", URL, payload, headers)

res = conn.getresponse()

data = res.read()

decoded_data = data.decode("utf-8")

json_data = json.loads(decoded_data)

return json_data

# Function to Backtest Donchian Strategy

def backtest_strategy(start_date, end_date, stock_token):

# Step 1: Fetch historical data

token_hist = get_bearer_token()

if not token_hist:

return None

json_data = get_ticker_data(start_date, end_date, stock_token, token_hist)

if 'result' not in json_data:

print("No historical data found.")

return None

df = pd.DataFrame(json_data['result'])

# Ensure the DataFrame has the required columns

df['high'] = df['high'].astype(float)

df['low'] = df['low'].astype(float)

df['close'] = df['close'].astype(float)

""" YOU CAN CONTINUE WITH YOUR STRATEGY HERE "

return df

# Example Usage

if __name__ == "__main__":

start_date = 1640995200000 # Replace with your start date (in milliseconds)

end_date = 1643673600000 # Replace with your end date (in milliseconds)

stock_token = "26000" # Replace with your stock token

backtest_strategy(start_date, end_date, stock_token)

Note:

- Stock Token can be accessed from https://v2api.aliceblueonline.com/restpy/contract_master?exch=NSE

- The millisecond formate is called as epoch time, you converter : https://www.epochconverter.com/ or write a custom code to convert.

- Once you get data from API, you can write your strategy to back test the data.

Conclusion of Algo Trading

Algorithmic trading revolutionizes financial markets by automating strategies, improving efficiency, and minimizing errors. Leveraging APIs, traders gain real-time market access, execute precise orders, and test strategies effectively. While it offers immense potential for profitability, it requires robust planning, risk management, and continuous monitoring. With the right tools and knowledge, algorithmic trading empowers both beginners and professionals to thrive in dynamic markets.

Read More : Algorithmic Trading Meaning – Working, Advantages and Strategies

FAQs – Algo Trading Meaning

For whom is algorithmic trading appropriate?

Algorithmic trading is accessible to anyone with programming skills, a working grasp of financial markets, and a trading account. Hedge funds, institutional investors, and retail traders all like it.

Does algo trading require programming knowledge?

Indeed, the development and implementation of algorithms require a fundamental understanding of programming languages like Python and Java. For people who don’t know how to code, there are no-code platforms and tools accessible.

How might algorithmic trading benefit from APIs?

Real-time data access, order execution, and account management are made possible via APIs, which link your trading algorithms to financial markets. They are necessary for trading strategy scaling and automation.

What is paper trading in algo trading?

Paper trading simulates real market conditions without risking actual money. It helps traders test strategies in a risk-free environment before going live.

Can I use machine learning in algo trading?

Yes, machine learning can be used to create predictive models and enhance trading strategies by analyzing patterns and trends in market data.

How do I choose the best algo trading platform?

Consider factors like API features, pricing, data access, integration options, and user reviews. Platforms like Zerodha, Alice Blue, and Dhan are popular choices for beginners.

Can algo trading guarantee profits?

No, algorithmic trading doesn’t guarantee profits. Success depends on the quality of strategies, market conditions, and effective risk management.

Is algo trading legal in India?

Yes, algorithmic trading is legal in India. However, it is regulated by SEBI (Securities and Exchange Board of India), and traders must comply with all rules and guidelines.

How much investment is required for algo trading?

The initial investment varies. Costs include account funding, API access fees (if applicable), and infrastructure like a computer and internet connection. You can start small and scale up.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Algorithmic trading involves substantial risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with financial advisors before engaging in any trading activities. The author and publisher disclaim any liability for losses incurred due to the use of information provided herein.