IPO Allotment Process: 4 Simple Steps, Best Allotment Tips, and Examples

An IPO (Initial Public Offering) is when a private company offers its shares to the public for the first time to raise capital. It allows investors to buy ownership in the company, while the company gains funds for growth, operations, or debt repayment. IPOs are listed on stock exchanges.

IPO Allotment Meaning

IPO allotment refers to the process of distributing shares to investors who apply during an IPO. Based on demand, shares are allotted through a lottery system for retail investors and proportional allocation for others. The allotted shares are credited to the investor’s demat account before the listing date.

How IPO Allotment Works?

IPO allotment in India is the process of distributing shares of a company to investors who have applied during the IPO subscription period. The process involves various categories of investors, specific allotment rules, and oversubscription management.

Step 1 : Application Process

- Investors apply for IPO shares via ASBA (Application Supported by Blocked Amount).

- Under ASBA, funds are blocked in the investor’s bank account until the allotment process is finalized.

Step 2 : Basis of IPO Allotment

- The allotment is determined based on the subscription levels and SEBI (Securities and Exchange Board of India) guidelines.

- If the IPO is under-subscribed (applications are fewer than shares available), all applicants receive full allotment of the shares they applied for.

- In Case of Over-Subscription, if the IPO is oversubscribed but not heavily, shares are allotted proportionally.

- Lottery System: If oversubscription is extremely high, allotment happens via a computerised lottery system. Each investor is eligible for at least one lot (minimum application size), ensuring fairness.

Step 3 : IPO Allotment Finalization Process

- After the IPO closes, the registrar (e.g., Link Intime, KFintech) processes all applications and finalizes the basis of allotment.

- The allotment status is usually published on the registrar’s website within 7 working days after the IPO closes.

Step 4 : Steps After IPO Allotment

- Shares Credited: Allotted shares are credited to investors’ demat accounts.

- Refunds for Unallotted Shares: For unallotted applications, the blocked funds are released.

- Listing on Exchanges: The company’s shares are listed on stock exchanges (e.g., NSE, BSE), and trading begins on the specified listing date.

Example on IPO Allotment Process

Let’s look at real-life examples of IPO allotment processes in India to understand how shares are allocated, especially in oversubscription scenarios.

Vishal Mega Mart IPO (2024)

Vishal Mega Mart IPO is open from Wednesday, December 11, 2024, with a price range of ₹74 to ₹78 per share. The fresh issue is valued at Rs 8,000.00 crores.

| Vishal Mega Mart IPO Details | |

| Open Date of Vishal Mega Mart IPO | Wednesday, December 11, 2024 |

| Vishal Mega Mart IPO Close Date | Friday, December 13, 2024 |

| Vishal Mega Mart IPO Price Range | ₹74 to ₹78 per share |

| Vishal Mega Mart IPO Fresh Issue | Rs 8,000.00 crores |

| Vishal Mega Mart IPO Listing Exchange | BSE, NSE |

| Vishal Mega Mart IPO Listing Date | Wednesday, December 18, 2024 |

| Vishal Mega Mart IPO Allotment Date | Wednesday, December 17, 2024 |

An application for 1 lot of Vishal Mega Mart IPO was made through stock broker platform, leading to ₹14,820 being blocked in the bank account under ASBA.

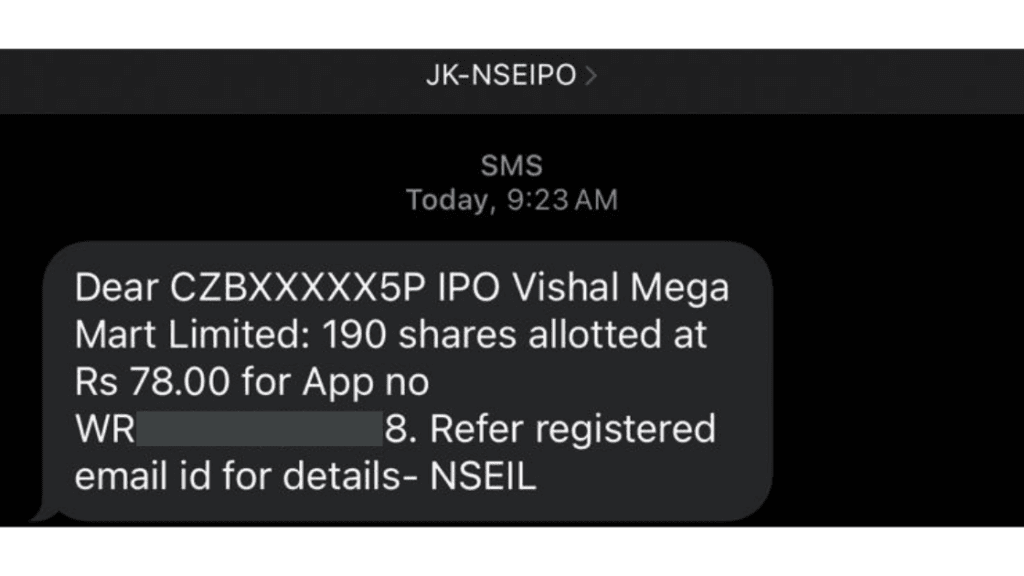

On the allotment day, the status was checked on Link Intime’s website, and it was found that 1 lot of 190 shares had been successfully allotted. Also received a SMS to the registered mobile number.

The shares were credited to the demat account on December 18, 2024, and their presence was verified through holdings.

Considering the strong brand presence in the retail sector and the company’s growth potential, holding the Vishal Mega Mart shares for the long term appears to be a favorable decision.

Eligibility for IPO Allotment

Eligibility for IPO allotment depends on factors such as the category of investor (retail, NII, or QIB), number of shares applied, and oversubscription levels. Retail investors can apply through ASBA or UPI, with a maximum investment limit of ₹2 lakh. Allotments are generally decided through a lottery system if oversubscribed, with larger investors receiving proportional allotments.

Factors Influencing IPO Allotment

Several factors influence IPO allotment, including:

- Oversubscription: If the IPO is oversubscribed, allotment is done via a lottery system for retail investors and proportional allocation for institutional investors.

- Application Size: Investors applying for larger lots have a higher chance of receiving allotment, especially in non-retail categories like QIBs and NIIs.

- Retail Investor Category: The allocation in retail categories is capped at ₹2 lakh per applicant.

- IPO Demand: Strong market interest and high subscription levels increase the chances of receiving shares in a lottery.

Steps to Apply for an IPO:

Here are the steps to apply for an IPO:

- Ensure Demat and Trading Account:

Before applying, ensure you have an active demat and trading account with a SEBI-registered broker. - Check IPO Details:

Research the IPO’s price band, issue size, open and close dates, and other relevant details. - Submit IPO Application:

You can apply for an IPO via:- UPI-based application (through apps like Zerodha, Groww, etc.).

- ASBA (Application Supported by Blocked Amount) via a bank account.

- Fill the Application Form:

Complete the application form with personal details and the number of lots you wish to apply for. - Block Funds:

Funds equal to the bid amount (for selected lots) will be blocked in your bank account (via ASBA or UPI). - Allotment Process:

After the IPO closes, the allotment will be processed. You can check the status on the registrar’s website (e.g., Link Intime, KFintech). - Shares in Demat Account:

If allotted, shares will be credited to your demat account on the allotment date. - Listing of Shares:

Once listed, the shares will be available for trading on the respective stock exchanges (NSE/BSE).

How IPO Allotment is Calculated?

IPO allotment is calculated based on several factors, primarily oversubscription and the type of investor:

- Oversubscription: If the IPO is oversubscribed, the allotment is done through a lottery system for retail investors. The higher the number of applications, the lower the chances of allotment.

- Proportional Allocation: For Institutional Investors (QIBs and NIIs), allotments are typically made in proportion to the number of shares applied.

- Lot Size: The allotment is made in multiples of the lot size, which is defined in the IPO terms. Larger applicants may receive a higher number of shares if demand is less than available shares.

- Retail Investor Limits: For retail investors, the maximum bid is capped at ₹2 lakh.

How to Check IPO Allotment Status?

How to Check IPO Allotment Status in NSE?

To check the IPO allotment status on NSE, follow these steps:

- Visit the NSE Website:

Go to the NSE’s official website:nseindia. - Search for IPO Allotment:

On the homepage, find the “Equity” section, then select “IPO” under the “Public Issues” tab. - Select the IPO:

Find the IPO you applied for in the list of recently closed IPOs. - Click on Allotment Status:

Select the “Allotment Status” link next to the IPO. - Enter Details:

You’ll be redirected to the registrar’s website (e.g., Link Intime, KFintech). Enter your Application Number and PAN Number to check the allotment status. - Check Status:

The status will show whether you were allotted shares or not.

How to Check IPO Allotment Status in BSE?

To check IPO allotment status on BSE, follow these steps:

- Visit the BSE Website:

Go to the official BSE website:bseindia - Go to “Equity” Section:

On the BSE homepage, hover over the “Equity” section and click on “Public Issues” from the drop-down menu. - Select “IPO”:

Click on “IPO”, which will take you to a list of recently closed IPOs. - Click on “Allotment Status”:

Locate the IPO you applied for and click on the “Allotment Status” link. - Enter Details:

You will be redirected to the registrar’s website (like Link Intime, KFintech, etc.). Enter your Application Number and PAN Number to check your allotment status.

What to Do After IPO Allotment?

After receiving an IPO allotment, here are the key steps to follow:

- Verify Shares in Demat Account:

Ensure that the shares have been credited to your demat account on the allotment date. You can verify this by logging into your trading platform or checking with your broker. - Monitor the Listing Day:

Keep an eye on the listing day, when the IPO shares are expected to be listed on the stock exchange (NSE/BSE). The listing price could be higher or lower than the IPO price, depending on market demand. - Decide on Holding or Selling:

- If the stock lists at a premium (higher than the IPO price), decide whether to sell for a quick profit or hold for long-term growth.

- If the stock lists at a discount, you might consider holding the shares if you believe in the company’s long-term potential, or selling if you want to limit your losses.

- Track Performance:

After the IPO listing, track the stock’s performance and news about the company. Keep an eye on financial results, market conditions, and other factors that could influence stock price movements. - Consider Long-term Investment:

If you believe the company has strong growth potential, consider holding the shares for the long term. You can also invest in more shares in subsequent market dips.

Read More: Senores Pharmaceuticals Allotment IPO

Why I Don’t Get IPO Allotment?

There are several reasons why you might not receive an IPO allotment, even after applying. Here are some common factors:

- Oversubscription:

If the IPO is oversubscribed, meaning more people apply than the available shares, allotment is done through a lottery system. In such cases, the chances of receiving an allotment are reduced. - Lower Number of Shares Applied For:

If you apply for a small number of shares, your chances of receiving allotment decrease, especially in highly subscribed IPOs. Large applicants or those applying for multiple lots might have a better chance. - High Competition in Retail Category:

Retail investors (those applying for shares worth ₹2 lakh or less) face stiff competition, especially when an IPO is popular. Even though your application may be valid, the allotment is based on demand and supply, and a limited number of shares may be allocated. - Bank or UPI Issues:

If there were issues with the bank’s ASBA facility or UPI payment, such as insufficient funds or a delay in payment, the application may be rejected. - Application Rejected by Registrar:

The registrar is responsible for processing the applications. Sometimes, due to system errors or mistakes in filling out the form, the application may not be considered.

Tips To Improve IPO Allotment Chances

Here are some effective tips to improve your chances of getting IPO allotment:

- Apply Through Multiple Accounts:

If possible, apply through multiple demat and trading accounts (family members, friends). This increases the number of applications, boosting your chances of getting an allotment. - Apply for the Maximum Lot Size:

Larger applications often stand a better chance of allotment, especially when the IPO is under-subscribed. However, applying for the maximum lot size increases your investment. - Avoid Last-Minute Applications:

Ensure you apply well before the closing date. Last-minute applications may face delays or errors due to high traffic or technical glitches.

Read More: JSW Cement IPO – GMP, Open Date and Other Details

What are the trading hours for a stock on its IPO listing day?

IPO Listing Day Trading Schedule

- 9:00 AM to 9:35 AM: Orders for IPO and re-listed instruments can be placed, modified, or canceled.

- 9:35 AM to 9:45 AM: Orders remain adjustable, but the system will close all orders randomly during this period.

- 9:45 AM to 9:55 AM: The exchange processes and matches orders to determine the stock’s opening price.

- 9:55 AM to 10:00 AM: A buffer period ensures a seamless transition to the regular trading session, with no order changes allowed.

- 10:00 AM to 3:30 PM: Regular trading hours allow placing, modifying, and canceling orders.

Conclusion

Improving IPO allotment chances requires strategic planning, such as applying through multiple accounts, choosing high-demand IPOs, and submitting applications early. While allotment is not guaranteed, these steps can increase the likelihood of success. Stay informed and apply wisely to maximize your opportunities in upcoming IPOs.

Frequently Asked Questions (FAQs) About IPO Allotment

How to verify IPO allotment?

To verify IPO allotment, visit the registrar’s website (e.g., Link Intime, KFintech) or the stock exchange (NSE/BSE). Enter your application number and PAN number to check the allotment status. Alternatively, you can check your demat account for the credited shares after the allotment date.

What time IPO is listed in stock market?

IPOs are typically listed on the stock market between 10:00 AM and 11:00 AM on the listing day, though the exact timing may vary. The listing price is determined based on market demand during the opening hours. It’s recommended to track the stock exchange for precise timings.

What is the logic for IPO allotment?

The logic for IPO allotment primarily depends on oversubscription and category of investors. In case of oversubscription, a lottery system is used for retail investors, while institutional investors receive shares based on proportional allocation. The allotment also considers factors like lot size and subscription demand.

What happens after the IPO allotment?

After IPO allotment, shares are credited to the investor’s demat account. Investors can then choose to hold the shares for long-term growth or sell them on the stock exchange on the listing day. The stock’s performance post-listing will influence the decision to hold or sell.

What is SME IPO allotment?

SME IPO allotment refers to the process of allocating shares in an SME (Small and Medium Enterprises) IPO to investors. SME IPOs are listed on specialized platforms like the NSE SME or BSE SME, designed for smaller companies to raise funds.

How To Check IPO Allotment Status?

To check IPO allotment status, visit the registrar’s website (like Link Intime or KFintech). Enter your PAN, application number, or DP ID/client ID. Alternatively, check on the BSE or NSE websites under the “Equity” section. Ensure correct details for accurate results. Allotment status is usually available a few days after the IPO closure.

What Is Gray Market Premium For IPO?

The Gray Market Premium (GMP) is the unofficial price at which an IPO’s shares are traded before listing. It reflects investor sentiment and demand for the stock. A positive GMP indicates strong interest, while a negative GMP suggests weaker demand. However, GMP is speculative and doesn’t guarantee the IPO’s listing price or post-listing performance.

Disclaimer

The information provided on Funds and Savings is for informational and educational purposes only and should not be considered as financial or investment advice.

Pingback: Mamata Machinery IPO GMP and Allotment Status

Pingback: Ather Energy IPO GMP Today - Ather IPO Date, Allotment