Mamata Machinery IPO GMP and Allotment Status: Everything You Need to Know

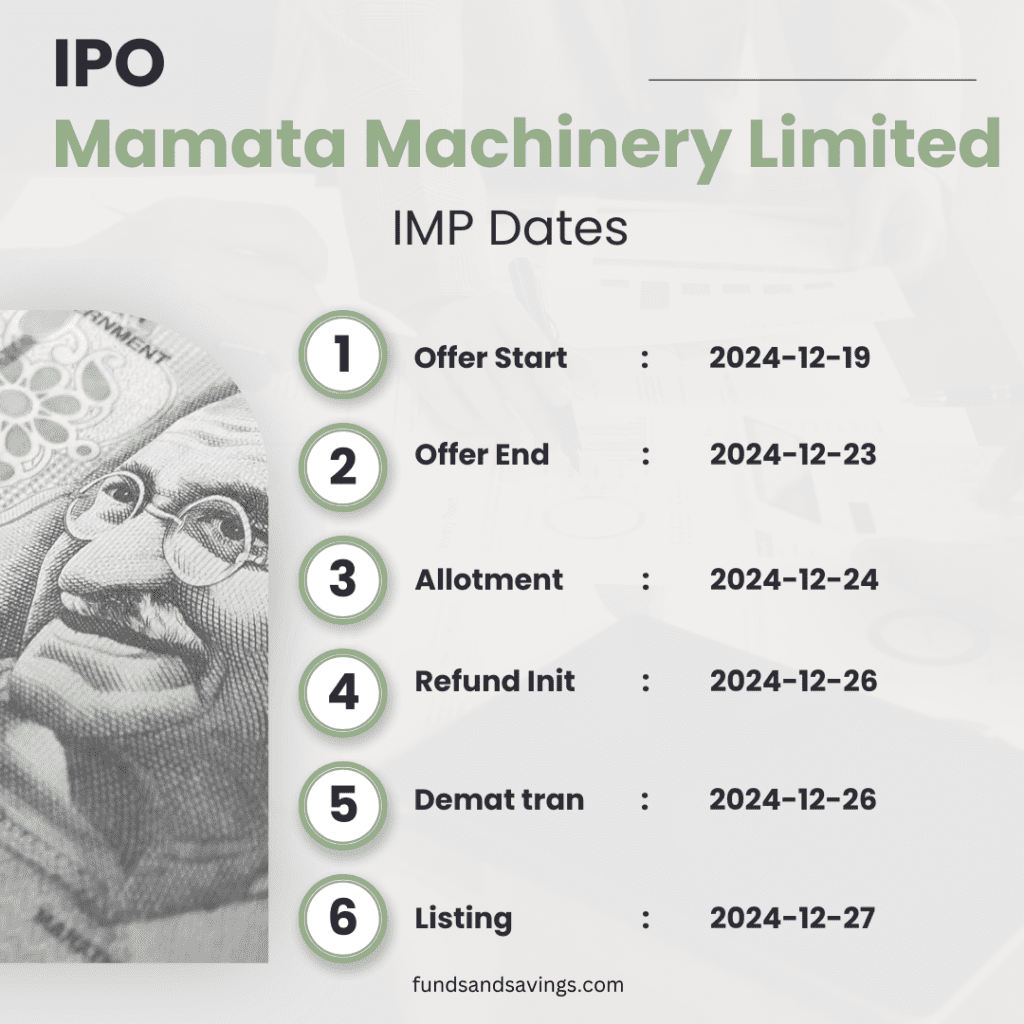

Mamata Machinery IPO Allotment and Listing Status: Everything You Need to Know allotment status date is Tuesday, December 24, 2024. The basis of allotment will be finalized on this date, followed by the initiation of refunds and credit of shares to Demat accounts on Thursday, December 26, 2024.

Mamata Machinery IPO Allotment Status

Mamata Machinery IPO allotment status date is Tuesday, December 24, 2024, when investors can check their allotment. The next process includes initiating refunds and crediting shares to investors’ Demat accounts as part of the finalization steps.

How to Check Mamata Machinery IPO Allotment Status

Once the subscription period ends, the allotment process begins. Here’s a step-by-step guide to check your Mamata Machinery IPO allotment status:

Via Registrar’s Website (e.g., Link Intime)

- Visit the registrar’s website (e.g., Link Intime).

- Click on “IPO Allotment Status.”

- Select “Mamata Machinery Limited” from the dropdown menu.

- Enter your PAN, application number, or DP ID/Client ID.

- Click “Submit” to view your allotment status.

Via BSE Website

- Go to the BSE India website.

- Under the “Investors” section, click on “IPO Allotment Status.”

- Select “Equity” and choose “Mamata Machinery Limited”

- Enter your application details and click “Search.”

If allotted, the shares will be credited to your demat account. Unsuccessful bidders will receive refunds to their bank accounts.

What Happens After Allotment?

After the allotment process, here are the next steps for investors:

- Refunds: For unsuccessful applicants, refunds are initiated within a few working days.

- Share Crediting: Successful applicants will have shares credited to their demat accounts.

- Listing Date: The shares will be listed on stock exchanges, typically within a week of allotment.

The listing day is crucial as it determines the initial trading price based on demand and supply dynamics.

Mamata Machinery Limited IPO Listing Date

Mamata Machinery IPO listing date is set for Froday, December 27, 2024. Listing marks the debut of the company’s shares on the stock exchange, allowing public trading. After listing, investors can buy or sell shares based on market demand.

Key Details of the Mamata Machinery IPO

The Mamata Machinery IPO provided investors an opportunity to participate in its public offering, with key details regarding the bidding dates, investment amounts, price range, and issue size outlined as follows:

- The bidding period for the Mamata Machinery IPO is from 19th December 2024 to 23rd December 2024.

- The minimum investment required is ₹14,823.00 for 1 lot, which consists of 61 shares.

- The price range for the shares is ₹230 to ₹243.

- The maximum investment allowed is 14 lots (854 shares), amounting to ₹2,07,522.

- The total issue size of the Mamata Machinery IPO is Rs 179.39 crores.

Understanding GMP and Its Importance

Grey Market Premium, or GMP, refers to the unofficial premium at which IPO shares are traded before their listing on the stock exchange. It provides an early glimpse into the market sentiment for the IPO.

Why is GMP Important?

- Investor Sentiment: A higher GMP indicates strong demand and positive market sentiment.

- Listing Gains: It helps investors gauge potential listing-day gains.

- Market Trends: GMP reflects broader trends in the stock market and sector.

For Mamata Machinery IPO, the current GMP stands at approximately 45.68% ( 111 Rs ), signaling strong investor interest. However, GMP is subject to volatility and should not be the sole criterion for investment decisions.

Read More: Mobikwik IPO Allotment and Listing Status: Everything You Need to Know

Factors Driving Mamata Machinery IPO Popularity

Mamata Machinery IPO has garnered attention due to several factors:

- Strong Industry Presence:

Mamata Machinery is a leader in the packaging and automation industry, backed by decades of expertise and a strong reputation. - Impressive Financial Performance:

Consistent revenue growth and profitability have attracted investors seeking companies with a solid financial track record. - Market Growth Potential:

With increasing demand for packaging solutions globally, the company is well-positioned to capitalize on industry expansion. - Innovative Product Portfolio:

The company’s focus on cutting-edge technology and sustainable packaging solutions adds to its appeal. - Grey Market Premium (GMP):

A high GMP reflects strong market sentiment, driving interest and anticipation for listing-day gains.

Risks and Challenges for Investors

While the IPO looks promising, it’s essential to consider potential risks:

- Market Volatility:

Stock prices can be highly volatile post-listing, influenced by market sentiment and external factors. - Overvaluation Risks:

IPOs, especially during high-demand periods, may be overpriced, leading to potential losses if the stock underperforms. - Business Uncertainty:

The issuing company’s future performance may not align with expectations due to industry challenges or operational inefficiencies. - Limited Information:

IPO prospectuses may not fully disclose risks or provide clear insights into the company’s long-term strategies. - Liquidity Concerns:

For smaller IPOs, such as SME listings, liquidity might be limited, making it harder to exit investments quickly.

Investors should weigh these factors carefully before making decisions.

Read More : IPO Allotment Process: 4 Simple Steps, Best Allotment Tips, and Examples

Conclusion

Investing in IPOs offers opportunities for significant gains but comes with inherent risks. Understanding the allotment process, market dynamics, and the company’s financial health is crucial. By applying strategic tips and staying informed, investors can improve their chances of success. Thorough research and risk assessment are key to making informed decisions and maximizing IPO investment returns.

Stay updated on Mamata Machinery IPO developments to maximize your investment journey. Happy investing!

Other IPO Allotment & Listing Status Details

Rosmerta Digital Services IPO Allotment Status

The Rosmerta Digital Services IPO will have the basis of allotment finalized shortly after its closure. Refunds will be initiated and shares credited to Demat accounts soon after. The IPO is expected to list soon, marking the next steps in the IPO process.

Transrail Lighting IPO IPO Allotment Status

The Transrail Lighting IPO will have the basis of allotment finalized shortly after its closure on December 23, 2024. Refunds will be initiated and shares credited to Demat accounts soon after. The IPO is expected to list on December 27, 2024.

Concord Enviro Systems IPO Allotment Status

The Concord Enviro Systems IPO will have the basis of allotment finalized shortly after its closure on December 23, 2024. Refunds will be initiated and shares credited to Demat accounts soon after. The IPO is expected to list on December 27, 2024.

DAM Capital Advisors IPO Allotment Status

The DAM Capital Advisors IPO will have the basis of allotment finalized shortly after its closure on December 23, 2024. Refunds will be initiated and shares credited to Demat accounts soon after. The IPO is expected to list on December 27, 2024.

Mamata Machinery IPO Allotment Status

The Mamata Machinery IPO will have the basis of allotment finalized shortly after its closure on December 23, 2024. Refunds will be initiated and shares credited to Demat accounts soon after. The IPO is expected to list on December 27, 2024.

Sanathan Textiles IPO Allotment Status

The Sanathan Textiles IPO will have the basis of allotment finalized on 23-Dec. The shares are expected to be listed on 27-Dec, marking the next steps in the IPO process.

Identical Brains Studios IPO Allotment Status

The Identical Brains Studios NSE SME IPO will have the basis of allotment finalized on 20-Dec. The shares are expected to be listed on 26-Dec, marking the next steps in the IPO process.

NACDAC Infrastructure SME IPO Allotment Status

The NACDAC Infrastructure BSE SMR IPO will have the basis of allotment finalized on 19-Dec. The shares are expected to be listed on 24-Dec, marking the next steps in the IPO process.

International Gemmological Institute IPO Allotment Status

The International Gemmological Institute IPO will have the basis of allotment finalized on 17-Dec. The shares are expected to be listed on 20-Dec, marking the next steps in the IPO process.

Read More: Senores Pharmaceuticals Allotment IPO

Disclaimer

The information provided on Funds and Savings is for informational and educational purposes only and should not be considered as financial or investment advice.