Old vs New Tax Regime for FY 2025-26: Which One Saves You More?

As we enter FY 2025-26, one important financial decision awaits salaried individuals and taxpayers: Which income tax regime should you choose – the old or the new?

With the government sweetening the new tax regime in Union Budget 2025, it might look like an obvious choice. But is it really the best one for you?

Quick Overview: Old vs New Tax Regime (FY 2025-26)

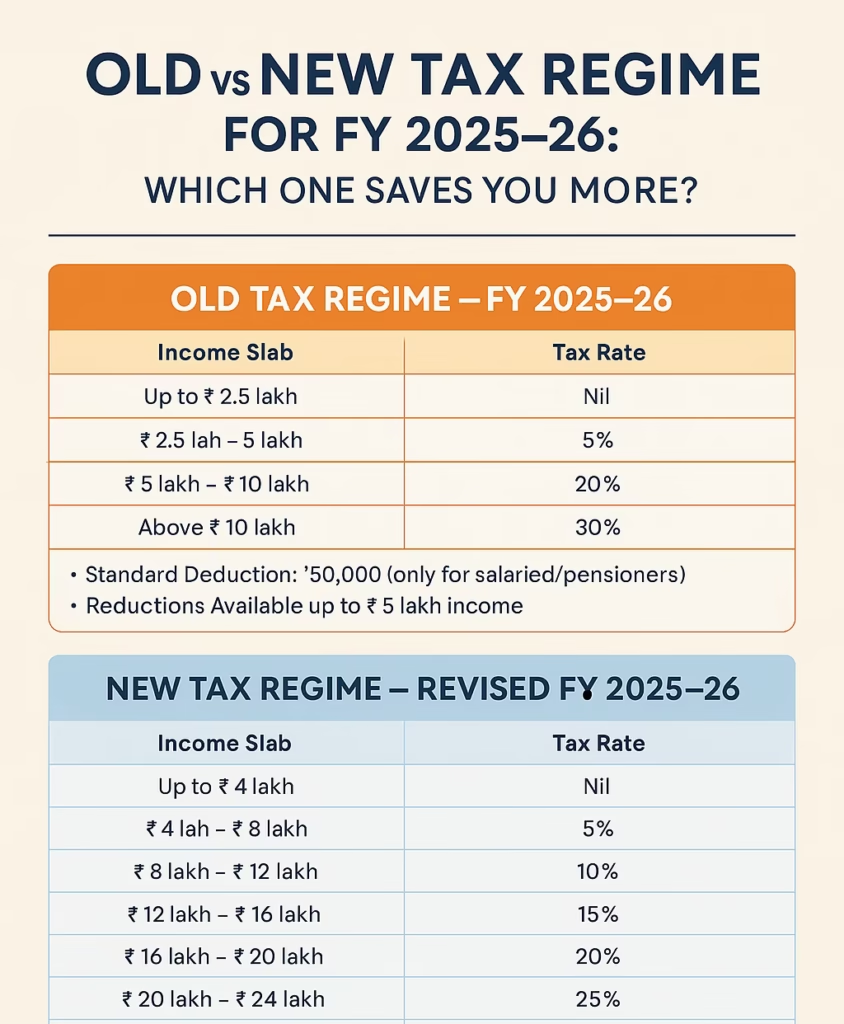

Old Tax Regime – FY 2025-26

| Income Slab | Tax Rate |

| Up to ₹2.5 lakh | Nil |

| ₹2.5 lakh – ₹5 lakh | 5% |

| ₹5 lakh – ₹10 lakh | 20% |

| Above ₹10 lakh | 30% |

- Standard Deduction: ₹50,000 (only for salaried/pensioners)

- Deductions Available: Yes (80C, 80D, HRA, etc.)

- Rebate under 87A: Available up to ₹5 lakh income

New Tax Regime – Revised FY 2025-26

| Income Slab | Tax Rate |

| Up to ₹4 lakh | Nil |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| ₹12 lakh – ₹16 lakh | 15% |

| ₹16 lakh – ₹20 lakh | 20% |

| ₹20 lakh – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

- Standard Deduction: ₹75,000 (salaried/pensioners only)

- Rebate: Full tax rebate for income up to ₹12 lakh

- Deductions: Limited (corporate NPS, etc.)

Who Should Choose the New Tax Regime?

Best For:

- Salaried individuals with no major investments or deductions

- Middle-income earners (₹6 – ₹12 lakh) who want zero documentation

- High-income individuals who prefer simplicity and lower compliance

Example:

| Income | Tax in New Regime | Tax in Old Regime | Deductions Needed (Old Regime) |

| ₹13 lakh | ₹25,000 (with rebate) | ₹1,87,500 | ₹8 lakh+ |

Thanks to the 60,000 rebate, income up to ₹12.75 lakh can be tax-free in the new regime (including ₹75,000 standard deduction).

Who Should Consider the Old Tax Regime?

Best For:

- Young professionals trying to build a habit of saving

- People who claim multiple deductions under 80C, 80D, HRA, home loan, etc.

- High-income earners who can claim deductions up to ₹8 lakh

Case Study: ₹6 Lakh Income

| Scenario | Tax Regime | Tax Payable | Strategy |

| No deductions | New Regime | ₹0 | Auto-tax-free |

| ₹50,000 deductions | Old Regime | ₹0 | But forced to save via NPS, ELSS, insurance |

Takeaway: Old regime acts as a “forced savings” mechanism — helpful for developing long-term financial discipline.

Read on : Investing in Gold in India: Comparing Physical Gold, Digital Gold, Gold ETFs, Gold Funds, and SGBs

Why “Locked-In” Investments Help

Investments like ELSS (3-year lock-in) or NPS (until retirement) restrict impulsive spending and offer:

- Better compounding

- Financial discipline

- Long-term wealth creation

Tax Comparison: At Various Income Levels

| Income | New Regime Tax | Old Regime Tax | Deduction Needed (Old Regime) |

| ₹12 lakh | ₹0 (after rebate) | ₹1.3 lakh approx | ₹2.5 – ₹3 lakh |

| ₹15 lakh | ₹75,000 | ₹2.25 lakh | ₹6+ lakh |

| ₹20 lakh | ₹2.5 lakh | ₹4.5 lakh | ₹8+ lakh |

Note: Beyond ₹24 lakh income, both regimes tax at 30%, so benefits depend entirely on available deductions.

Final Thoughts: How to Decide?

| If You… | Consider This Regime |

| Prefer no paperwork or proof | New Regime |

| Have high investments/deductions | Old Regime |

| Are just starting your career | Old Regime (to build savings habits) |

| Have income below ₹12.75 lakh | New Regime (tax-free) |

| Earn over ₹15 lakh & can’t invest | New Regime |

| Earn over ₹15 lakh & can invest ₹6–8L | Old Regime |

Pro Tips Before Choosing:

- Include all sources of income (salary, FD interest, rent, capital gains)

- Consider taxation rules of each investment avenue

- Use a tax calculator or consult a financial advisor

- Factor in insurance, retirement, and long-term goals

Conclusion

The new tax regime is simpler, cleaner, and more appealing — but the old regime rewards disciplined savers with smart tax breaks.Don’t go with the crowd. Analyze your income, deductions, and financial habits before making a choice.