Gaudium IVF IPO Allotment Status: 7 Important Updates Today

Gaudium IVF IPO Allotment Status is expected to be finalized on February 25, 2026, after the subscription period closes. This date is important because investors will know whether they have received shares or not, helping them plan refunds, listing expectations, and next investment decisions accordingly.

Gaudium IVF IPO Allotment Status also indicates overall investor demand and subscription strength. A strong response may reduce allotment chances for retail investors but can signal positive market sentiment. Checking the allotment result on time helps investors track refunds, demat credit, and listing preparation smoothly.

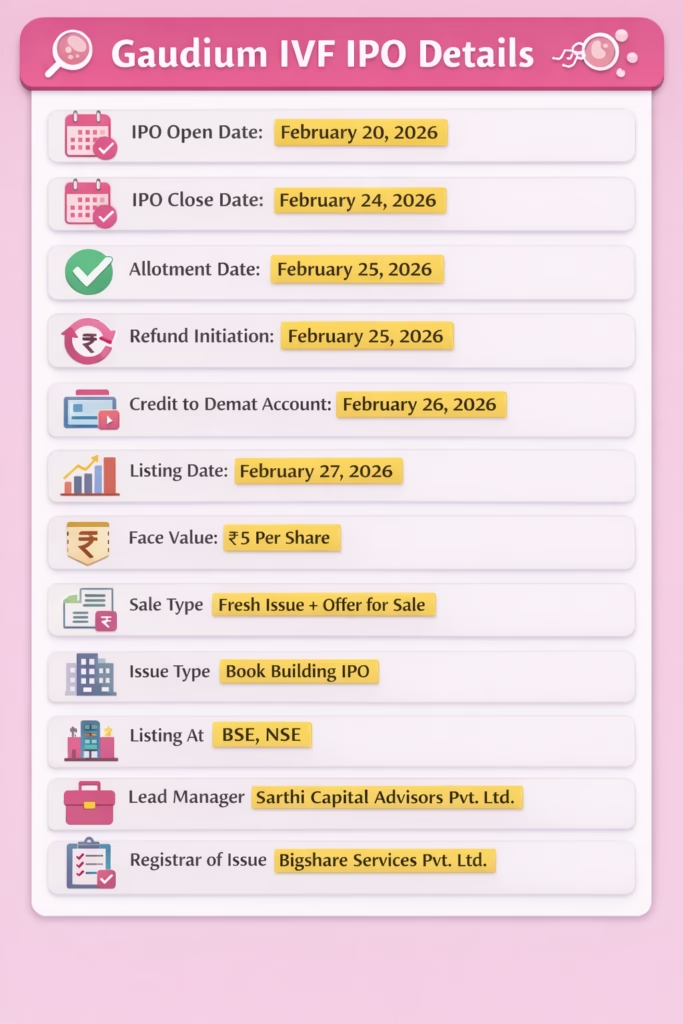

Gaudium IVF IPO Details

Gaudium IVF IPO will open for subscription on February 20 and close on February 24, with allotment expected on February 25 and listing on stock exchanges on February 27,2025.

| Gaudium IVF IPO Details | Information |

| IPO Open Date | February 20, 2026 |

| IPO Close Date | February 24, 2026 |

| Allotment Date | February 25, 2026 |

| Refund Initiation | February 25, 2026 |

| Credit of Shares to Demat | February 26, 2026 |

| Listing Date | February 27, 2026 |

| Face Value | ₹5 per share |

| Sale Type | Fresh Issue + Offer for Sale |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE, NSE |

| Book Running Lead Manager | Sarthi Capital Advisors Pvt.Ltd |

| Registrar of Issue | Bigshare Services Pvt.Ltd |

Read More: Algorithmic Trading Meaning

How to Check Gaudium IVF & Women Health Ltd IPO Allotment Status?

- Visit the registrar’s official allotment page “Bigshare Services Pvt.Ltd” to check Gaudium IVF & Women Health Ltd IPO Allotment Status.

- You can open IPO Allotment Status Page and enter PAN, application number, or DP ID details.

- Log in to your stockbroker or IPO application platform and open the IPO orders section to view allotment updates.

- Select the Gaudium IVF IPO application from your order list to see whether shares are allotted or not.

- Check email or SMS notifications sent by the registrar or broker regarding allotment confirmation.

- Ensure your application details like PAN and demat account are correct before checking status.

- If shares are allotted, they will be credited to your demat account before listing.

- If not allotted, blocked funds are released automatically through the ASBA process.

What Happens After Gaudium IVF IPO Allotment?

- After Gaudium IVF IPO Allotment, allotted shares are credited to the investor’s demat account before the listing date.

- If shares are not allotted, the blocked amount in the bank account is released automatically under ASBA.

- Investors can check demat holdings to confirm share credit before trading begins.

- The company’s shares then list on stock exchanges, where market price is determined by demand and supply.

- Investors may choose to sell on listing day for gains or hold for long-term investment.

- Listing performance often depends on subscription demand, GMP trend, and market conditions.

- Tracking allotment and listing helps investors plan exit or holding strategy properly.

Read More: Most Expensive Stocks in India

Gaudium IVF IPO Listing Date

Gaudium IVF IPO Listing Date is scheduled for February 27, 2026, when the company’s shares are expected to begin trading on the BSE and NSE. This milestone is important because it determines the actual market price and potential listing gains or losses for investors.

Gaudium IVF IPO Listing Date reflects investor sentiment built during subscription, GMP trends, and overall market conditions. A strong listing can provide quick returns, while weak performance may lead to losses. Therefore, understanding the listing timeline helps investors decide whether to hold or sell shares.

Gaudium IVF IPO GMP

Ahead of the Gaudium IVF IPO opening on February 20, 2026, reports indicate that there is currently no grey market premium (GMP) available for the issue in the unofficial market. This usually happens when trading interest in the grey market has not yet developed or price discovery is still pending.

However, Gaudium IVF IPO GMP can change quickly once the IPO opens or closer to listing. In some updates, unofficial tracking sources have even shown negative or discounted GMP levels, highlighting uncertain short-term sentiment and reminding investors that GMP is only an informal indicator, not a guaranteed listing signal.

Gaudium IVF IPO DRHP

Gaudium IVF IPO DRHP is the draft document filed with the market regulator that explains business details, financial performance, risks, and fund usage. The company plans to use proceeds for new IVF centres, debt repayment, and general corporate purposes, highlighting future expansion plans.

Gaudium IVF IPO DRHP is important for investors because it provides transparent information needed to evaluate the company before investing. Reviewing financial growth, operational model, and expansion strategy helps investors make informed long-term decisions instead of relying only on market sentiment or GMP trends.

Gaudium IVF IPO Subscription Status

Gaudium IVF IPO Subscription Status represents the number of times the IPO is subscribed by different investor categories during February 20 to February 24, 2026. This data is important because higher subscription generally signals strong demand and positive listing expectations.

Gaudium IVF IPO Subscription Status also helps investors understand participation from institutional, retail, and non-institutional investors. Strong institutional interest can improve confidence in the IPO’s fundamentals, while weak demand may indicate cautious sentiment, influencing listing performance and short-term investment strategies.

Read More: Investment Myths Busted

Risks and Challenges for Investors of Gaudium IVF & Women Health IPO

1. Dependence on healthcare quality and reputation

- As a fertility healthcare provider, the company faces operational and reputational risks linked to treatment quality, regulatory compliance, and patient satisfaction.

- Any negative clinical outcome, legal issue, or compliance failure could impact brand trust, revenue stability, and long-term financial performance.

2. Reliance on key professionals and expansion execution

- The business depends heavily on specialist doctors and skilled medical staff, making retention critical for service continuity.

- Planned expansion of IVF centres using IPO funds increases execution risk, operational complexity, and capital requirements, which may pressure margins if growth slows.

3. Competitive and regulatory industry environment

- The IVF sector faces intense competition, pricing pressure, and strict regulatory approvals, which may limit profitability or delay expansion.

- Failure to maintain licenses or comply with healthcare regulations could negatively affect operations, investor confidence, and market valuation.

4. Technology dependence and legal exposure

- IVF treatment relies on advanced medical technology and procedures, creating risk from equipment failure, rising costs, or rapid technological change.

- Ongoing or potential legal proceedings may also create financial liabilities or reputational damage if outcomes are unfavourable.

5. Financial growth with scale-related uncertainty

- The company shows strong recent growth, with FY24 profit rising about 22.7% to ₹16.89 crore and revenue increasing 20.9% to ₹53.48 crore, plus ₹8.28 crore profit in the first half of FY25.

- However, sustaining this growth during rapid expansion remains uncertain for investors.

6. IPO structure and promoter share sale considerations

- The IPO includes both fresh issue funding and promoter offer-for-sale, which may signal partial promoter exit alongside growth fundraising.

- Investors should evaluate whether expansion benefits outweigh dilution and changing promoter shareholding dynamics after listing.

Read More: Best Gold Stocks in India

How to invest in Gaudium IVF & Women Health IPO?

- To invest in Gaudium IVF & Women Health IPO, first open a demat and trading account with a SEBI-registered broker.

- Apply through the ASBA or UPI method, where the application money is only blocked in your bank account until allotment.

- Fill IPO bid details, enter lot quantity, and provide a valid UPI ID during the application process.

- Approve the UPI mandate request in your payment app to block funds for the IPO application.

- Ensure sufficient bank balance because funds remain blocked until allotment is finalized.

- Submit the application before the IPO closing date to participate successfully.

- After allotment, shares are credited to demat and become tradable on listing day.

Read More: 5 Smart Money Hacks to Secure Your Financial Future

Conclusion – Gaudium IVF & Women Health IPO

- Gaudium IVF IPO Open Date is February 20, 2026, and Close Date is February 24, 2026.

- Gaudium IVF IPO Allotment Date is February 25, 2026, which is important because investors will know share allocation status and refunds or demat credit will begin immediately after this stage.

- Gaudium IVF IPO Listing Date is February 27, 2026, when shares are expected to start trading on BSE and NSE.

- Gaudium IVF IPO consists of around 2.09 crore equity shares, including a fresh issue and offer-for-sale, which indicates both expansion funding for the company and partial promoter dilution.

- Gaudium IVF IPO Face Value is ₹5 per share and follows the book-building issue structure, helping price discovery through investor bidding and supporting listing on major exchanges for broader participation.

- Overall, Gaudium IVF & Women Health IPO reflects growth potential in the fertility healthcare sector, but investors should evaluate fundamentals, subscription demand, and market sentiment before applying for listing gains or long-term holding,

FAQ – Gaudium IVF IPO Allotment Status

When will the Gaudium IVF IPO allotment status be announced?

Gaudium IVF IPO allotment status will be announced on February 25, 2026, after the subscription closes on February 24.

- Confirms share allocation

- Triggers refund or demat credit

- Helps investors prepare for listing decisions

What is the Gaudium IVF & Women Health Limited IPO?

Gaudium IVF IPO opens on February 20, 2026, and closes on February 24, 2026. These dates define the official bidding window for investors applying through ASBA or UPI and determine eligibility for allotment in this public issue.

What is the open and close date of the Gaudium IVF IPO?

Gaudium IVF IPO opens on February 20, 2026, and closes on February 24, 2026. These dates define the official bidding window for investors applying through ASBA or UPI and determine eligibility for allotment in this public issue

What is the Gaudium IVF & Women Health Limited IPO size?

Gaudium IVF & Women Health Limited IPO includes about 2.08 crore equity shares through a fresh issue and offer for sale. This structure helps the company raise expansion funds while allowing existing shareholders to partially exit.

How to invest in Gaudium IVF IPO?

To invest in Gaudium IVF IPO, follow these steps:

- Open demat and trading account

- Apply via ASBA or UPI

- Choose lot size and submit bid

- Approve mandate before closing date

These steps ensure valid participation in the IPO process.

How can I check the Gaudium IVF & Women Health IPO allotment status online?

Gaudium IVF & Women Health IPO allotment status can be checked on the registrar’s website “bigshare services pvt.ltd” by entering PAN, application number, or DP details. Investors may also verify status through broker platforms once the basis of allotment is finalized.

What details are required to check the Gaudium IVF & Women Health Limited IPO allotment status?

To check Gaudium IVF & Women Health Limited IPO allotment status, investors need PAN, application number, or demat account details. These identifiers help the registrar securely match the application and display allotment results quickly after finalization.

What happens if I don’t get any shares in the Gaudium IVF IPO?

If Gaudium IVF IPO shares are not allotted, the blocked application amount is released automatically.

- Refund begins after allotment

- No separate request needed

- Funds return through ASBA system

This protects investor money during IPO participation.

When will the refund be processed for un-allotted investors?

If shares are not allotted in the Gaudium IVF IPO, the blocked application amount is released automatically. Refund initiation generally occurs on the allotment date, ensuring investors regain funds without needing to submit a separate request.

When will the Gaudium IVF & Women Health Ltd IPO shares be credited to the Demat account?

Gaudium IVF & Women Health Ltd IPO shares are scheduled to be credited on February 26, 2026. Investors should check demat holdings after this date to confirm receipt before trading begins on the stock exchange listing day.

What is the Gaudium IVF & Women Health Ltd IPO listing date?

Gaudium IVF & Women Health Ltd IPO listing date is February 27, 2026. On this day, shares begin trading on BSE and NSE, and the market determines the actual price based on demand and supply.

Which registrar is handling the Gaudium IVF IPO allotment process?

Bigshare Services Private Limited is the registrar for the Gaudium IVF IPO. The registrar manages allotment finalization, refund processing, and investor queries, making it the primary platform to check application and allotment status.

Can I check the Gaudium IVF IPO allotment status on NSE or BSE websites?

Gaudium IVF IPO allotment status is mainly available on the registrar’s website, while NSE and BSE provide listing and corporate filing information. Investors should rely on the registrar portal for accurate allotment confirmation.

What is the lot size for the Gaudium IVF & Women Health IPO?

The exact lot size for the Gaudium IVF & Women Health IPO is yet to be announced. Investors should check the final RHP or broker platform before applying, as lot size determines the minimum investment required in the IPO.

How will I know if I have received the Gaudium IVF & Women Health Limited IPO shares?

Investors will know they received Gaudium IVF IPO shares once they appear in the demat account. Confirmation may also arrive via SMS or email from the registrar or broker after share credit is completed before listing.